Why synthetic biology investors need to look beyond Silicon Valley and Boston

Jan 15, 2019

Synthetic biology, the field concerned with the design and construction of novel biological systems, has received intense interest from both startup investors and the broader media. The amount of investment in the area has skyrocketed lately as the field begins to realize its potential to disrupt any industry that deals with physical material. Though synthetic biology companies can have enormous environmental and societal benefits, there have been some concerning trends in the geographic distribution of investment in synthetic biology companies.Investments have been increasingly concentrated in a few narrow areas. This mirrors the concentration of investment in information technology, where Silicon Valley, along with a few other areas, dominated the field. Though companies in information technology have generated significant value, this value has not been distributed equally across the nation, which has likely contributed to the divide between urban and rural areas. It is important that synthetic biology, which could be the next industrial revolution, not repeat the same mistakes. In addition to ensuring that synthetic biology is bringing value to everyone in the country, investors that only focus on San Francisco or Boston risk missing out on all the incredible talent that is distributed across the nation.Many of the early industrial synthetic biology companies were based in southern California - mostly San Diego - likely due to the expertise in algal biotechnology that is concentrated there. Some of the best companies from that time period, like Synthetic Genomics and Genomatica, are still active in the area. However, during the second wave of synthetic biology, the share of rounds raised by companies in southern California has steadily declined, having been replaced by companies in other geographies. The area that has gained the most over the past 10 years is northern California - comprised of the San Francisco Bay and Sacramento areas.Ultimately, over 60% of recent investments have gone to just two small geographic areas, northern California and the northeastern United States. It is very important to note that this concentration is not because there are no worthy companies founded in different areas. Companies within these two areas that receive an SBIR or STTR grant raise follow-on funding roughly 50% of the time, whereas companies in outside of these areas raise follow-on funding only around 17% of the time. Any company that is awarded an SBIR or STTR grant has proven their science to some degree, so there must be some other factor behind the lack of investor interest.The geographic bias in synthetic biology investments is concerning. Synthetic biology has the potential to disrupt almost every industry, but if companies are concentrated in a few areas, they will lack access to the diverse industries spread across the country. Most large agricultural and chemicals companies are not located in northern California or the northeastern US. Investors would do well to find companies in areas like the Midwest and Texas that have a greater concentration of these industries and thus, would better be able to build relationships with these potential customers. In addition, startups based out of these regions will have access to talent that has experience with their target market and can operate with greater capital efficiency.

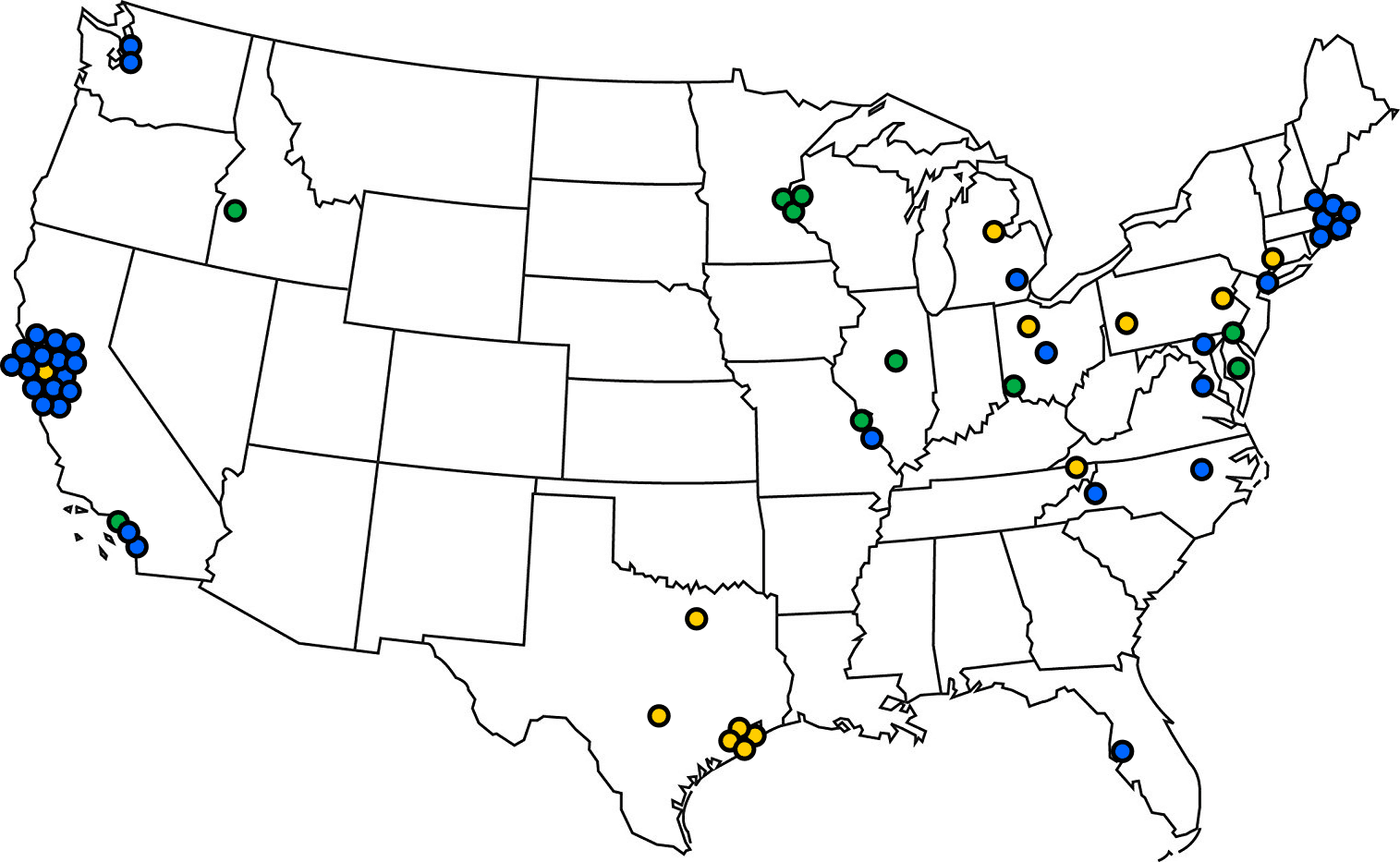

Headquarters of largest US agriculture (green) and chemicals (yellow), compared to recent fundings of synthetic biology startups (blue) in those spacesThe disparity in funding likely comes down to the fact that most of the venture capital money in the United States, especially life sciences-focused money, is invested out of firms based in Boston and San Francisco. These firms could expand the geographic scope of their investments by working with the local industry groups and research institutions that will be producing these companies. Some of the best agricultural and chemical research programs in the country are in these areas of the country, and will produce sold deal flow. Ultimately, expanding the geographic footprint of synthetic biology will not only yield more promising companies, but also ensure that the field is focused on bringing value to the diverse populations in our country.