There Is No Problem Biology Can't Solve…Except For Economics

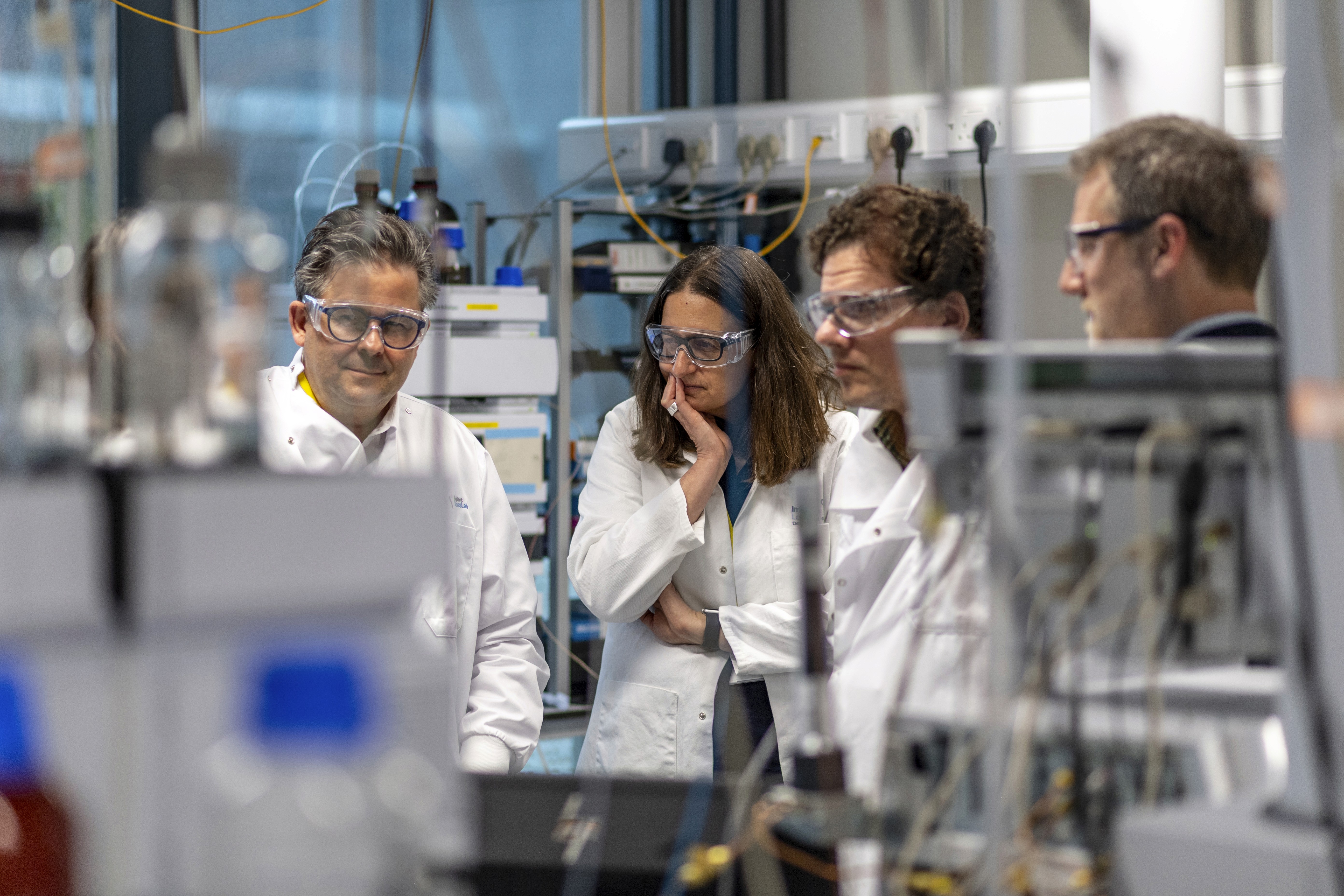

Biomanufacturing, which uses organisms like yeast, bacteria, and algae to produce a variety of products, faces significant challenges in economics and infrastructure

Aug 1, 2023

Reptile8488 (Canva)

Do you remember when the first fully electric vehicles came out in the early 2000s, and we all said, "Neat, but where are you going to plug it in?" Now—pause for emphasis—a full two decades later—electric vehicles are starting to become commonplace, but they still only account for about 1% of US auto sales.

Electricity is cool, as long as it doesn't come from burning coal, but what if our fuel sources could be not only carbon neutral but actually carbon negative? That is the promise of biology.

Yeast, bacteria, plants, and algae can use a huge variety of fuel sources—sugar, organic waste, and even greenhouse gases – to produce molecules that we can use for fuel, medicine, plastics, building materials, clothing, cosmetics, and more.

"It requires a bunch of tinkering and some cell engineering. But you can get [microorganisms] to consume basically anything and make basically anything," said Joshua Lachter, Co-Founder of Synonym Bio, a financing and development platform for biomanufacturing. "That's the idea, the hope, and the dream."

Synthetic biologists at universities and companies around the world have shown that we can use biomanufacturing to produce hundreds of materials that are currently unsustainably sourced. So, what's the hold-up?

For electric vehicles to become more ubiquitous, two shifts have occurred: One in economics, fuel prices went up, and the cost of manufacturing electric vehicles went down; One in infrastructure, EV charging stations popped up everywhere from condos to coffee shops.

In order for biomanufacturing to reach its full potential, we have to build an infrastructure, and it's got to be cheap. Although many brilliant minds and companies are cooking up new ways to brew bioproducts, comparatively few are working on solving the infrastructure and scale-up problem.

One exception is Synonym Bio.

"The biomanufacturing revolution cannot come to fruition without the actual physical capacity to do it, and that capacity doesn't exist," said Lachter. We know that capacity doesn't exist because Synonym built an online resource for tracking and reporting biomanufacturing capacity called Capacitor.

Currently, the most tractable module for biomanufacturing is fermentation. In fermentation, yeast or bacteria are grown in bioreactors that range up to about 500 gallons. Then, whatever product they are engineered to produce is extracted and purified. Bioreactors are expensive to build and maintain, and the extraction process is highly specialized, which is why most of the current capacity is used to produce pharmaceuticals.

"When you're using biomanufacturing to get a pharmaceutical, you don't need very much of it, and you can sell it for—I think the technical term is—a shitload of money," said Lachter. In other words, pharmaceuticals can be profitable, even if they're very expensive to produce. For that reason, there is a network of companies called Contract Development and Manufacturing Organizations (or CDMOs) that specialize in biomanufacturing drugs.

The D in CDMO is important because, in addition to the biomanufacturing capacity, it can take a lot of trial and error to optimize the biomanufacturing process for a given bioproduct. That's where a company called Invert Bio comes in.

"A big piece is how do you design better experiments, better leverage the data that you have generated, to better understand your process, what changes could be made, and what sort of optimization can be done without doing everything empirically," said Alex Felt, head of Business Development at Invert. Invert has developed software custom-built for managing and learning from biomanufacturing data.

According to Felt, there are three steps involved in getting a new biomanufacturing product to market. Step 1: identify a product where biology is the right solution—this is where most synthetic biology startups begin and end. Step 2: partner with a CDMO to validate that your process can scale. Step 3: get a loan to build your biomanufacturing facility. That whole process can take 8-10 years and cost hundreds of millions of dollars—at which point, most investors start getting pretty antsy.

So, how do we speed this process up and, even more importantly, cut costs? Companies like Invert Bio and Culture Biosciences are working to speed up Step 2 with better, smarter, more collaborative approaches to fermentation.

Part of this process includes modeling scale-up to avoid sunk costs before the validation process even begins. To that effect, Synonym built a tool called Scaler™. Scalar is a free techno-economic analysis tool that circumvents the need to pay consultants or CDMOs thousands to validate or invalidate the scalability of a biomanufacturing product—essentially skipping Step 2 entirely.

"We have a number of investors that are using Scaler to vet companies. Now both on the venture side, and ultimately on the infrastructure side," explained Edward Shenderovich, Synonym's other Co-Founder and CEO.

So you can vet your biomanufacturing idea with Scaler and then find capacity with Capacitor. If that capacity doesn't exist, on to Step 3.

Most biomanufacturing capacity is custom-built for pharmaceuticals, which means it's probably not cost-effective for more commodity products. A company called Liberation Labs recently came out of stealth mode and is focused on biomanufacturing capacity specifically for food and biomaterials. And if you can't find capacity for your next big bioproduct there, Synonym has one more card to play. They'll help you get it financed.

"We can't use venture capital money to build biomanufacturing capacity. We need infrastructure investors," explained Lachter. "And they don't want to invest in a single asset. We need to create an asset class."

It's too risky to invest in expensive infrastructure for a single potential bioproduct that might flop. The idea is to identify an ecosystem of users who can share capacity and expertise. That, according to Lachter, is how you get the big companies like Proctor & Gamble, Dow Chemical, and Nestle, which he noted are currently standing on the sidelines, to help bring these bioproducts to market.

Of course, government incentives would help too. The Department of Defense is investing in every stage of the biomanufacturing commercialization process, including staffing and supply chain security, via the BioMADE project. The BioMADE project sees biomanufacturing capacity as a matter of national security, and currently, the US is behind on capacity compared to Europe, where Sanofi and Novo Nordisk, the largest manufacturers of insulin, are both headquartered.

The Biden Administration's Bold Goals to replace 90 percent of plastics by 2040 are a push in the right direction. Because plastic is a cheap byproduct of oil, as we move away from using fossil fuels for cars, there will be nothing to subsidize plastic, and costs will go up, noted Shenderovich.

In that sense, electric cars are a friend to the nascent biomanufacturing industry. Right now, the industry is in its Prius phase. There are interesting products, but they must fit into existing infrastructures or be specialty enough to invoke a high premium. What we need right now is not more electric cars but more plugins.

Thank you to Jenna Gallegos for additional research and reporting on this article.

(Originally published on Forbes)