The Next Industrial Revolution: Computational biology & bioplatforms

Mar 5, 2019

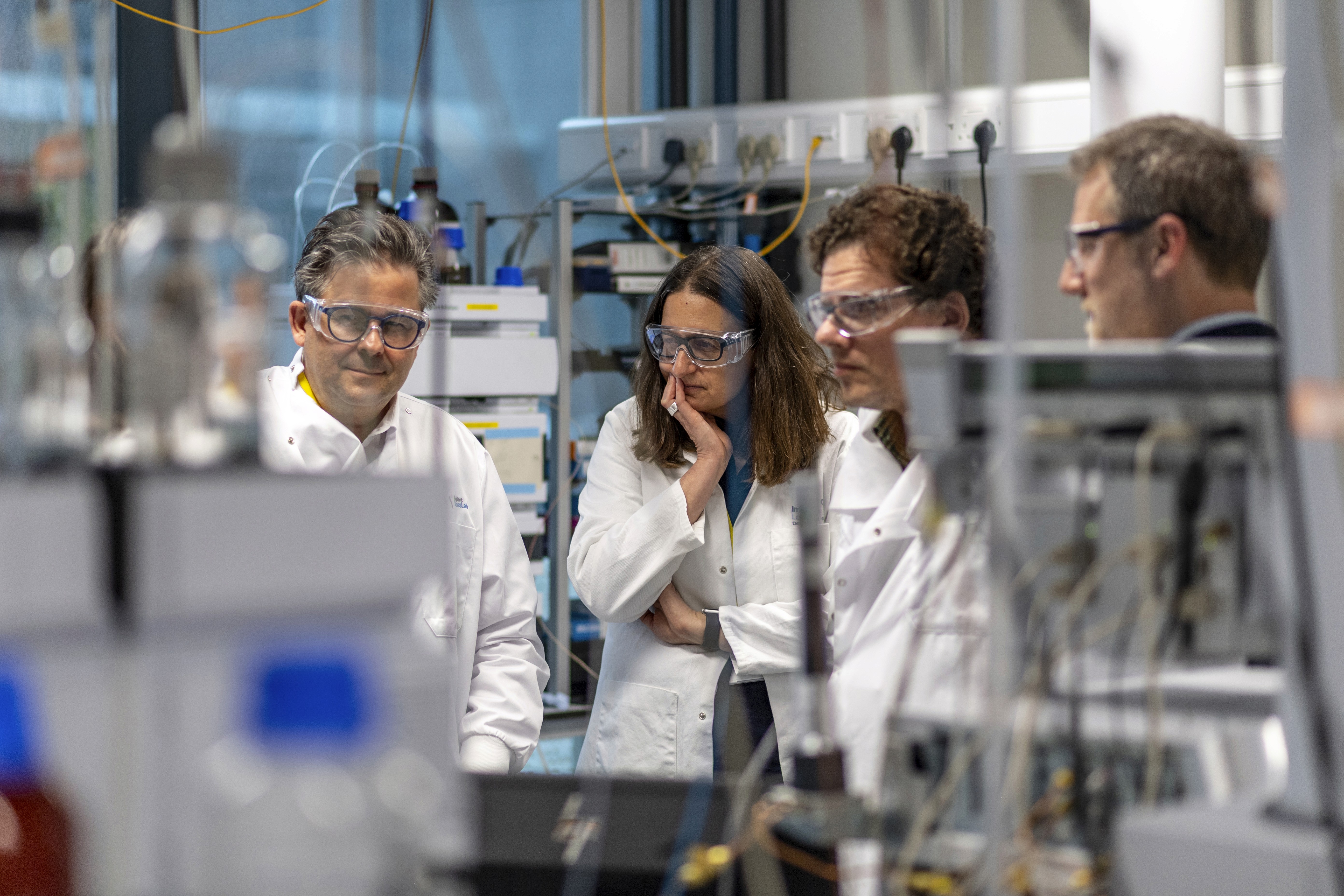

Innovation in biology is increasingly driven by software and data. Two-sided platform network effects, data network effects, software, speed, robotics, platforms – these operational approaches came to biology in just the last few years, yet they have been familiar to us at NFX for decades as software Founders & investors. This is our wheelhouse, and biology is coming this way.Three main technological shifts are driving this:

DNA sequencing and synthesis

AI, machine vision, & machine learning

Automation (biological data collection & manipulation in the lab)

Each of these technologies is seeing Moore’s Law -like drops in costs and increases in speed. If Moore’s Law gave us the software and internet boom, what will all three of these trends combined give us?

We like to call this space computational biology (CompBio) and it represents a new class of high-impact companies. These are companies that combine unique insights in both disciplines, without compromising either, and are creating new disciplines and startups in the process. This new approach is changing the playbook for scientific discovery, and we expect it to catalyze countless highly-important breakthroughs in the world of life sciences.

This is important

It bears mentioning that computational biology is objectively important. We’re talking about life itself: human DNA; the food we eat; infectious diseases; the evolution of species, and so on. "Biology is the only technology that can directly address fundamental problems facing the world like planetary and human health," says Arvind Gupta, Managing director & Founder of IndieBio and partner at SOSV. "These are world scale problems looking for technological solutions that will be developed in the next 20 years and those that do stand to create trillions of dollars of value". Rather than manufacturing tools for us to use, like cars or software, we’re now beginning to manufacture life itself.Jennifer Doudna, co-inventor of CRISPR and co-Founder of Mammoth Biosciences(an NFX portfolio company) told us, "Scientists have spent centuries carefully studying how living things work. We have now entered into a new era of biology where it is possible to move beyond observation and towards rewriting the underlying code of living things, creating countless opportunities to improve the world we live in, from diagnosing and treating human disease to restoring the environment around us."Further, something that has become clearer to us at NFX in the last three years: computational biology touches every industry. There are at least 90 companies worth over $20BN that are eyeing the CompBio space: agriculture; industrial; pharma; energy companies; plus all the big tech companies, like AWS, Google, and Microsoft. (Microsoft, for example, is developing a data storage system inside DNAthat it hopes can replace cumbersome tape drives).All of these industries are looking deeper at computational biology, trying to see how it is going to impact them.

The network effects of computational biology

Computational biology companies, if designed properly, can benefit from network effects in several ways.

Bioplatforms

First, we anticipate that among the most successful CompBio companies will be bioplatforms that leverage a two-sided platform network effect.We’re already starting to see this play out. Here’s how it works.A company builds a platform which combines a) bio IP, b) software, and c) a central database. The platform allows the company to build products rapidly, but it also allows them to partner with many external players who can use the platform to build their own products faster and cheaper. By opening up that platform to others and letting them drive their own business agendas more effectively with the platform than without the platform, enormous resources and energy can be brought to bear in a short period. Further, all the data generated by all the experiments flows back into the platform. The more partners that use that platform, the better the platform works for everyone. This allows the bioplatform to advance faster than any non-platform competitor.This platform approach is being adopted by many companies including Zymergen, Gingko Bioworks and Mammoth Biosciences (an NFX portfolio company).

Data network effects

Traditionally, the area we see data network effects is around AI, MV and ML.The principle of data network effects is this: with more data, companies are able to 1)improve their core product features2)lower costs, and 3) speed time to market. All of this gives them an advantage over their competitors which then, in turn, leads to capturing more data and even more advantages over their competitors.It’s important to note that data network effects are typically a weak form of nfx. They don’t last forever and are typically overstated by Founders and overestimated by investors. However, data nfx can work for many years and give the company a head start in building other defensibilities.To strengthen data network effects a company wants to gather the right type of bio data that can give you a data network effect. For instance, data needs updating regularly or needs to be real time. As an example, Mammoth Biosciences (an NFX portfolio company) is developing a suite of biosensing tools that people can use out in the field. The data collected in the field will be incorporated into their databases to, for example, track flu viruses as they move across the US. People will use their tools out in the field, add that data into their smartphone, and send that information back into the company. The more people add to that real time database, the more valuable it could become for all users, making Mammoth the most valuable choice for such applications.

Reinforcing defensibilities

The two strategies of bioplatforms and data network nfx can help to reinforce each other. The bioplatform, for example, can facilitate data capture from their users in order to feed the “flywheel” of their data network effect.

Confidence is growing

A small number of unicorn companies have emerged in the CompBio space and are serving as proof points for Founders and investors –– companies like Illumina, Intellia, Stemcentrx, and Twist. We’re now actually into the 2nd wave of CompBio startups.At the same time, the first wave of CompBio startups paved a way for future startups who can learn from the mistakes oftheir predecessors. We’re starting to see an increase in business-oriented Founders partner with scientists out of academia.

The VC ecosystem around compbio is maturing

Traditional investors in biology (like NEA, Venrock, Deerfield, and OrbiMed) continue to do great work. But in the last 36-months, we’ve seen top software firms jump into the CompBio mix.The older players see these newcomers as tourists at best, naive dilettantes at worst. But the newcomers likely will bring computational experience to the table as well as a penchant for speed that will only strengthen the overall funding ecosystem.

Further, a host of computational biology accelerators have jumped in to help fund and guide CompBio companies in the formation phase. IndieBio, Tech.bio (an NFX portfolio company), Age1, YCBio, and many others.Given the capital intensive nature of biology – especially as compared to traditional software – a strong ecosystem of venture capital will be critical to the success of CompBio companies. That ecosystem is now in place, as of just the last three years.

Bio is harder than software

One warning for the newcomers: bio is not software. It’s much harder. Often, it simply doesn’t work. It’s life. And it’s orders of magnitude more complex than the software that gave birth to big companies in the last 25 years. So don’t be deceived.Second, it’s more expensive than software. $5M seeds are normal and $25M series A’s are not unusual in this space. Most big successful biotech companies raise $100M or $250M before they exit, potentially decreasing returns when compared to software companies. Investors and Founders must plan for that.

Observations from the field

The SynBioBeta Conference run by John Cumbers is the biggest of its kind in the US. Yet, honestly, it still feels a lot like the Internet Conference in New York in 1994. Or the Crypto Meetings in 2013. There were about ~800 people there, mostly heads-down enthusiasts, few booths, and a lot of awkward discussion among people who are more familiar with the lab than conferences. "When we ran the first SynBioBeta in 2012, I jokingly called it a 'synthetic biology startup self help group,'" Cumbers told me. "As the industry has grown, the network has grown with it, but that feeling of companies and investors helping each other out still remains."At the most recent conference there was a palpable feeling that something is happening. Something big is about to shift.This industry is concentrated geographically in the SF Bay Area, Boston, San Diego, and Israel, more or less. And over the last two years, the Bay Area has become MORE concentrated (not less) as hundreds of startups have packed up and moved here. We know of at least four different large real estate developments building lab space for these startups in the Bay Area, and it won’t be nearly enough for the demand.

Next in compbio

We think the most interesting opportunities in computational biology in the next three years will be in:

Longevity

Immunotherapy

Applications of CRISPR

And when we see a company forming, we see these characteristics as positive:

Bioplatform approach to network effects

Data network effects with AI, ML & MV

Direct to Consumer or Direct to Industry, that can grow quickly

Streamlined FDA involvement or no FDA involvement

Companies in SF Bay Area, Boston or Israel

Capital-efficient approaches

We can’t wait to see what world class Founders come up with next. Come talk to us. It’s going to be a wild – and important – ride.