Ai Digital Biology

SynBioBeta Weekly Wrap: May 30, 2014

May 31, 2014

Check back every Friday afternoon for the SynBioBeta Weekly Wrap. Have news? Send an email to Maxx Chatsko at maxx.chatsko@synbiobeta.com.

It was a busy week for the field of synthetic biology. Twist Bioscience put the rest of the DNA synthesis industry on notice, Solazyme announced the start-up of its massive and complex facility in Brazil, Amyris announced the closing of an offering of up to $90 million in convertible debt notes, and The New York Times published an article highlighting activist groups' concerns over synthetic biology ingredients making their way into consumer products. Let's take a closer look.

Twist Bioscience announces $31.1 million in funding

After spending the prior 10 months creating a prototype machine, the next-generation silicon-based DNA synthesis platform being developed by Twist Bioscience moved a lot closer to commercial production this week. Twist Bioscience announced the closing of a $26 million Series B round and a $5.1 million DARPA contract earned through the Living Foundries: 1,000 Molecules program. CEO Emily Leproust said the funding will be used to hire approximately 80 new employees (bringing the total team size to about 100) that will work together automating and scaling the platform in the next 18 months.

The financing brings the total raised by Twist Bioscience to $40.2 million in just 10 months, which works out to a $92 per minute. SynBioBeta recently interviewed Leproust about the financing, the technology platform, and the widespread frustrations with the current DNA synthesis industry.

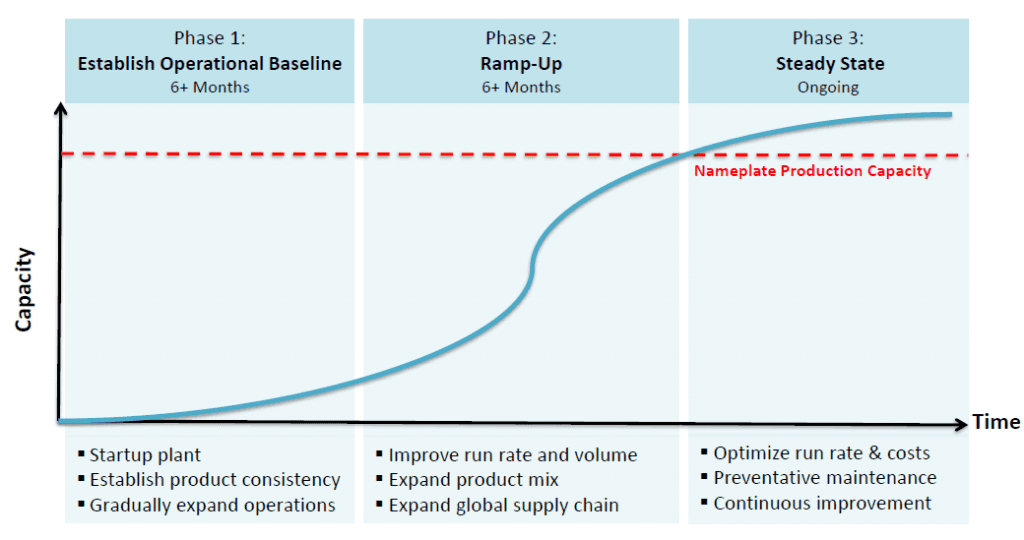

Solazyme announces start-up of 100,000 MT renewable oils facility

After a series of unexpected delays that began in the fourth quarter of 2013, renewable oils manufacturer announced the start-up of its commercial facility in Moema, Brazil. The facility was constructed with partner and feedstock (sugar cane syrup) supplier Bunge and is part of the Solazyme Bunge Renewable Oils joint venture. Solazyme estimates that it will take 6-9 months to demonstrate consistent and reliable operations for the heterotrophic algae platform, which will be followed by 6-9 months to ramp production at the facility to its annual nameplate capacity of 100,000 metric tons (MT).

Once Moema is producing at nameplate capacity in 12-19 months, Solazyme will have approximately 122,000 MT of annual capacity spread across three commercial facilities. Given that the company is targeting an average selling price of $2,000 per MT of production across its platform, the currently disclosed capacity will have an annual revenue potential of approximately $244 million. An additional 80,000 MT of capacity is planned in two expansion projects at its Clinton, Iowa facility, while an additional 200,000 MT is planned with Solazyme Bunge Renewable Oils, although dates have not been set and plans have not been finalized. Management has stated that it is in expansion talks with feedstock suppliers representing an annual capacity of 1 million MT.

Amyris closes $75 million financing

Synthetic biology pioneer Amyris announced the closing of an offering of $75 million in convertible debt notes, which could be expanded to $90 million if the initial purchaser decides to purchase an additional $15 million in notes. The funding will help strengthen the company's balance sheet during a critical time in development. It's also encouraging to see repeat investors participating in the financing, such as Temasek (which purchased $10 million despite purchasing $28 million in notes in the first quarter) and Director John Doerr (purchased $5 million of notes).

You can read through the SEC filing for the technical details, but it's important to know that Amyris will end up with a bit less cash than reported. If the maximum amount of notes is offered, then Amyris will walk away with net proceeds of about $86 million to stash with the $49 million it held at the end of March. However, it needs to repay a $25 million loan acquired in the first quarter and has already paid the energy giant Total, which owns approximately 20% of Amyris, $9.7 million to exchange old notes for new ones. In other words, Amyris will end the second quarter with close to $100 million in cash, which could possibly be used to complete its unfinished 65,000 MT facility (twice the size of the facility in Brotas, Brazil).

The New York Times reports on synthetic biology products

Synthetic biology earned a shout-out in the New York Times today. While it highlighted the concerns of various activist groups related to the use of ingredients created from synthetic biology processes in consumer products, the article did not take a stance on the issue. It did, however, appear to rely more heavily on the opinions of activist groups such as ETC Group, Consumers Union, and Friends of the Earth, although many companies (with the exception of Solazyme) declined comment. You can't inform the media of your technology or your field if you don't talk to the media. Period.

There were two inaccuracies reported in the article. First:

At this point, the field is largely unregulated. A scientific committee of the United Nations Convention on Biological Diversity is expected to discuss the budding science and the potential regulatory implications at a meeting next month.

There may not be regulations directly related to synthetic biology, but there are regulations related to genetic engineering and biology. This is more of a misunderstanding. Could new regulations be introduced that address synthetic biology more directly? Perhaps, but technology often develops at a faster pace than regulatory framework. This is not a problem that fits solely on the shoulders of the synthetic biology industry or the broader use of genetic engineering, although it is often characterized as such.

Second:

The industry is preparing to address questions about the impact of using such technology. This month, SynBioBeta, which bills itself as “an organization dedicated to nurturing stable growth of the fledgling synthetic biology industry,” hosted a forum where companies like Amyris, Evolva, Monsanto and DuPont Industrial Biosciences discussed how best to shape public perception and prevent regulatory scrutiny.

While it's great to get some recognition in The New York Times, it's clear that the author's perception of SynBioBeta and the recent Cultured Food Forum was shaped solely by Friends of the Earth. The article did, after all, link to a misleading Friends of the Earth blog post to describe the event.

To clarify, the meeting was designed to be closed-door and off-the-record. That's not because there was anything to hide, but because it was the first time the industry was coming together to discuss the "opportunities and challenges facing synthetic biology food ingredients". SynBioBeta does plan on holding additional meetings on the subject in the future that will be open to the public and consumer groups. At this point, the industry is still trying to figure out exactly what concerns consumers have, what issues companies face, and how the industry can work together to have an honest discussion with consumers. Simply put, you don't enter the Daytona 500 if you're just learning how to drive.

Rather than be applauded for taking a proactive approach to consumer concerns (how long did it take biotech seed producers to address consumer concerns?), the meeting has been characterized as a discussion about how best to wiggle around regulations (regulatory agencies were also at the meeting) and pull the drape over consumers (the need for transparency and addressing consumers openly and honestly featured prominently). That couldn't be further from the truth.

You can read The New York Times article here.