Desci

Illumina CEO Francis deSouza Resigns Amid Controversial Grail Acquisition

Jun 12, 2023

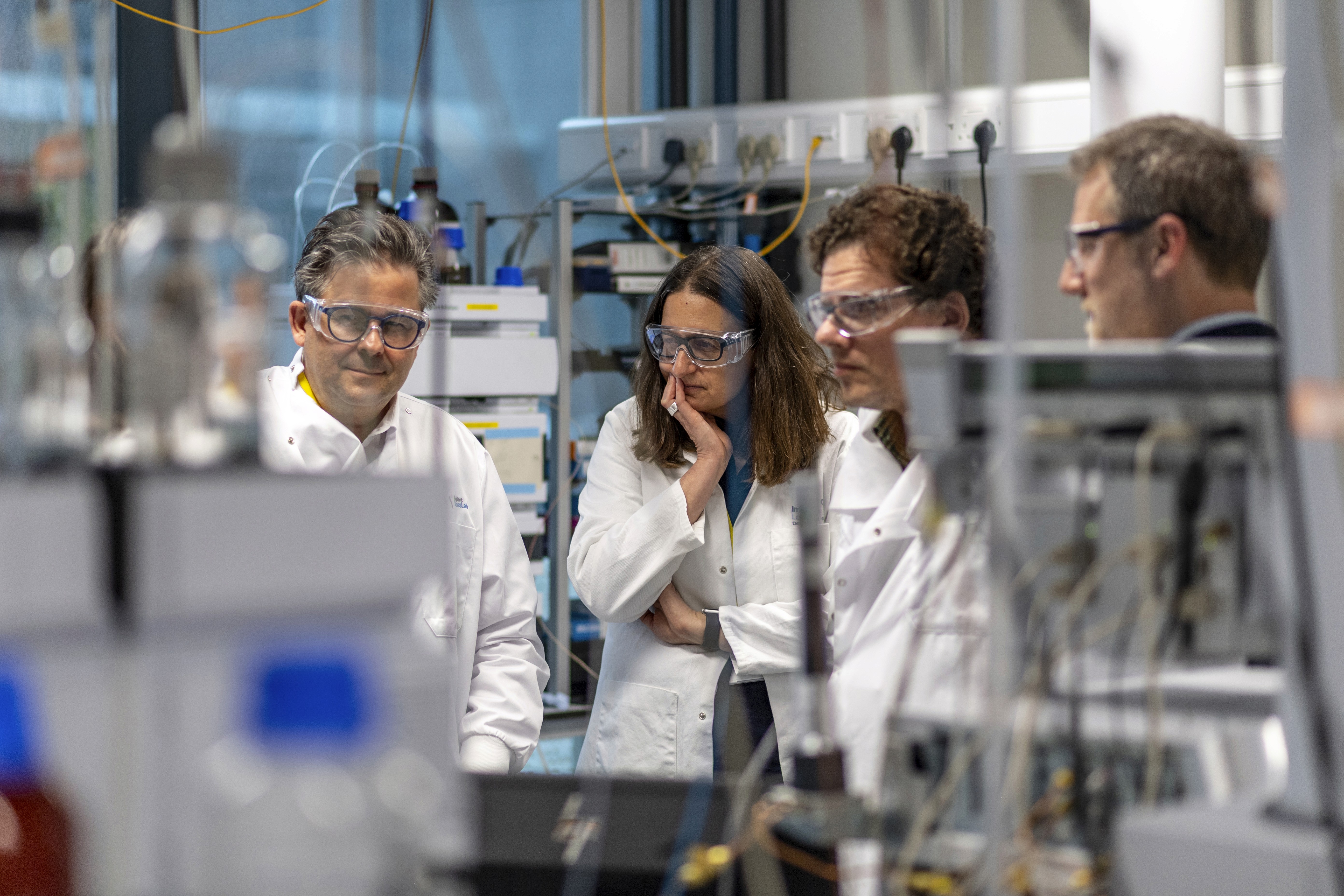

Credit: Illumina

Illumina has recently announced the resignation of its CEO, Francis deSouza. This development follows a contentious acquisition of Grail, a cancer diagnostic test maker, and a subsequent proxy battle initiated by activist investor Carl Icahn.

A pioneer in gene-sequencing technology, Illumina acquired Grail in 2021 for $7.1 billion, despite opposition from US and European antitrust regulators. Grail, a company specializing in cancer diagnostic tests, was initially a spin-off from Illumina and later repurchased by the parent organization. This acquisition attracted the attention of activist investor Carl Icahn, who argued that the deal had cost Illumina's investors billions of dollars and should be divested.

In response to the Grail acquisition, Carl Icahn launched a proxy battle against Illumina, seeking to persuade shareholders to vote out the company's Chairman, John Thompson, and CEO, Francis deSouza. Icahn's efforts culminated in a May vote that led to Thompson's ousting and the installation of Icahn's nominee, Andrew Teno. The activist investor has since expressed interest in bringing back former Illumina CEO Jay Flatley.

After the proxy battle unfolded, Illumina announced that its board had accepted the resignation of CEO Francis deSouza. In the interim, Charles Dadswell, the company's Senior Vice President and General Counsel, has been appointed acting CEO. Illumina has initiated a search for a permanent replacement, considering both internal and external candidates. DeSouza, who has been with Illumina since 2013 and served as CEO since 2016, will remain in an advisory capacity until July 31.

Since the completion of the Grail acquisition in 2021, Illumina's shares have lost approximately 60% of their value. However, the announcement of deSouza's resignation prompted a 2.2% increase in premarket trading. Analysts, such as TD Cowen's Dan Brennan, believe that the likelihood of a Grail divestiture has increased with deSouza stepping down, potentially attracting more investors to Illumina.

The Grail deal "has kept a lot of investors out of the stock," Brennan noted. "With Francis now stepping aside, I think the certainty of a Grail exit definitely goes up."

Following the recent developments at Illumina, Carl Icahn expressed satisfaction with the changes in the company's leadership. In a tweet, he called the board additions, CEO transition, and change of Chairman "significant positives" that should drive value for all stakeholders and benefit human health.

Despite his resignation, Francis deSouza remains committed to the potential of Grail's technology and the benefits of merging it with Illumina. In a letter to employees posted on LinkedIn, he stated that his belief in Grail's life-saving technology and the merger's advantages remain unshakable.

In addition to the ongoing CEO search and leadership changes, Illumina has filed an appeal against an order from the US Federal Trade Commission (FTC) demanding the company divest Grail due to competition concerns. The outcome of this appeal will likely significantly impact the future of Illumina and Grail.

The resignation of Illumina CEO Francis deSouza marks a turning point in the company's ongoing battle with activist investor Carl Icahn and the controversial Grail acquisition. As Illumina searches for a new CEO and contends with regulatory challenges, the company's future and relationship with Grail remain uncertain. Regardless of the outcome, the developments at Illumina serve as a reminder of the complex interplay between corporate leadership, investor activism, and regulatory oversight in today's business landscape.