How is the Current Synbio Startup Climate Affecting Innovation in the Global South?

Despite the dominance of synbio companies in traditional hubs like Boston, the Bay Area, and the UK, emerging firms in Latin America and Southeast Asia are making a global impact—how does founding in the global south benefit them, and are they equally affected by the current investment climate?

Jan 23, 2024

AI Image Created Using DALL-E

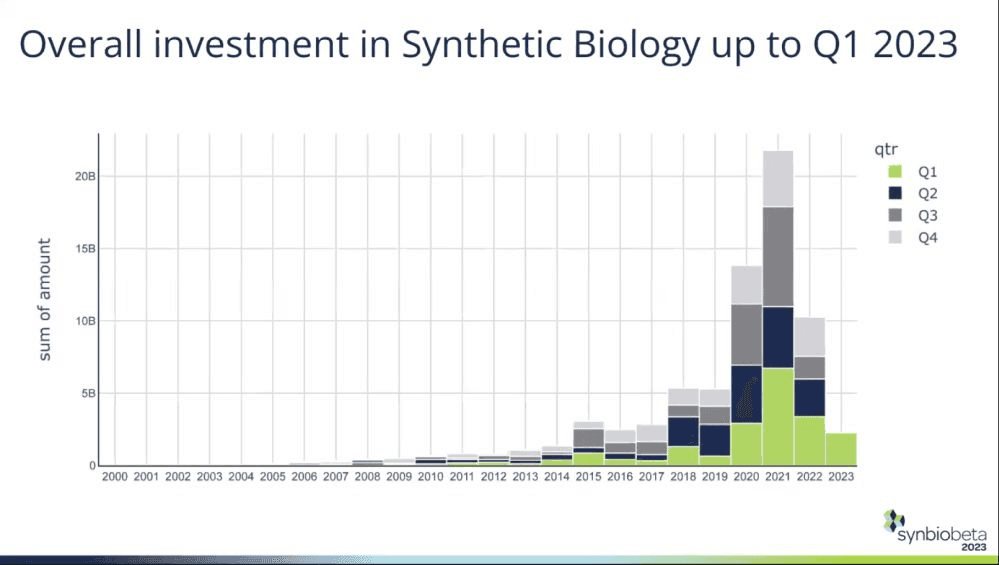

2020 and 2021 saw unprecedented investments in the Synthetic Biology sector. The realization that biology is important to solve real-life crises, such as a global pandemic, and the low-interest rates made investors pour money into ideas and solutions using biology as an engineering component. This created a plethora of startups with a varying range of scientific soundness and well-thought (or not-so-well-thought) business models.

2022 brought a rise in interest rates, inflation, and major geopolitical events that shifted the attention to energy and global supply chains. The investments in synthetic biology startups dropped to less than half. This might sound drastic. However, the overall investment is still significantly higher than in 2019. Investing in synthetic biology is here to stay, though the investors have maybe become more cautious and less eager to support ideas and ventures without a clear path to the market.

Some companies were especially hard hit by the new, tight investment climate. As funding rounds became smaller and more challenging to close, companies had to downsize or switch business models. The challenges synbio flagships such as Zymergen and Amyris faced made the VCs even more cautious. The tight investment climate has certainly made startups harder to grow in the traditional synbio hubs, such as Boston, the Bay area, or the UK. However, how does this mentality shift affect companies in the global south, such as in South Asia or Latin America?

Latin America, Strong Talent, and an Appetite for Impact

Latin America has seen an explosion of new ventures, accelerated during the Covid-19 pandemic. The main drivers of this growth are people and spending efficiency. “Latam is one of the most cost-effective places in the world to start a new biotech business,” Francisco Buchara, managing partner of SF500, an innovation fund aiming to boost technological development in Argentina, said. “The scientific community is also very strong and internationally recognized, with no lack of suitable technical talent,” he added.

Nicolas Berman, Partner at Kaszek, an investment fund focusing on Latin America, shares the same positive view about the local entrepreneurship potential. “It’s getting better and better for life sciences. There is a clearer understanding of potential impact”, he said. Berman mentioned two of their portfolio companies as examples of synthetic biology innovation in the region. NotCo uses AI and biotechnology to revolutionize the food industry by offering plant-based alternatives. PhageLab is battling multidrug-resistant bacteria, with significant activity in animal farms and large poultry producers, using phage cocktails that prevent or cure infections.

When asked about the effects of the current investment client, both Buchara and Berman do not see significant challenges in raising funds and closing rounds for their portfolio companies. Their opinion is that a company with a clear path to a large market, a good team, and good science will advance and convince the right people to support them.

South (East) Asia, A Place to Scale Up Your Company

Subramani (suBBu) Ramachandrappa recently founded Fermbox Bio in India, following the transformation of his first venture, Richcore Lifesciences, into a successful CDMO under the name of Laurus Bio. suBBu sees himself as part of a vivid ecosystem. “A lot more collaborative effort needs to go into strengthening the Synthetic Bio industry. We believe Knowledge is in pockets, and we plan to connect these pockets of knowledge”, he said. Fermbox Bio recently partnered with BBGI from Thailand to gradually create fermentation facilities of up to 1 million liters in Thailand for biomanufacturing synthetic biology products. Thailand is ramping up its position as a synthetic biology player. In 2021, 17 organizations established the Thailand Synthetic Biology Consortium, and since then, the number of synthetic biology startups and research in the ecosystem has steadily grown.

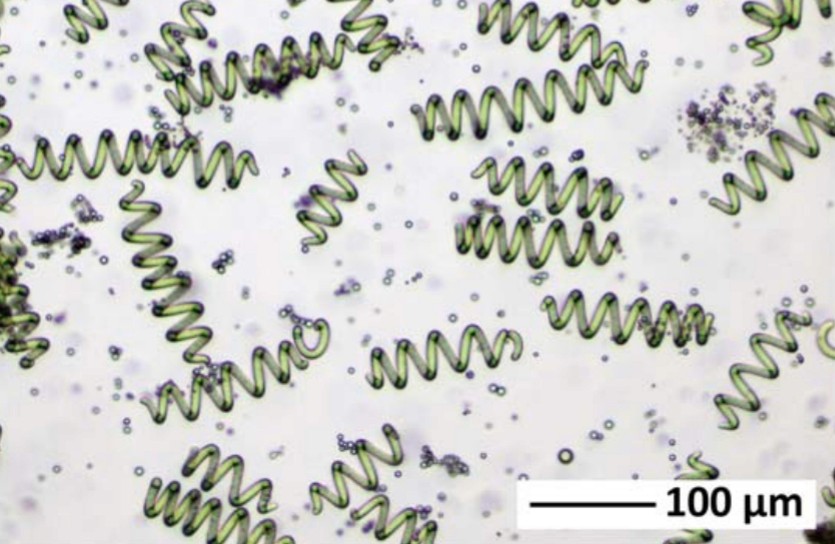

Sudhir Kumar Pasupuleti founded Algrow Biosciences in Singapore in 2022. The company uses algae and proprietary technology to sustainably produce nutraceuticals, such as pigments and polysaccharides. Yet, since early 2023, most of the company’s activities moved to India. “The infrastructure has improved to the point that we can seamlessly run R&D and operations,” Pasupuleti said. He mentioned that the Indian government is supporting more and more biotech startups and makes the ecosystem more conducive. Another factor is talent. Pasupuleti thinks that India provides a large talent pool with the right fit at a competitive cost compared to countries such as Singapore. However, he sees some major advantages in having a dual presence in both countries, especially regarding fundraising and exposure to partners and clients.

Neither suBBu nor Pasupuleti faced significant challenges in raising funds for their needs. South East Asia is capitalizing on talent, often trained overseas, and the more pragmatic approach of founders and support ecosystem. Moreover, the innovators are not afraid to seek support overseas when necessary. The development of new tools, especially in fields such as AI and its integration in synbio, accelerates product development. Also, South (East) Asian companies seem to think ahead in terms of scale-up and product design with the customer in mind.

Global South is Where Synbio Innovation Will Have the Most Impact

The overall outlook of synthetic biology startups in the global south appears positive despite the challenges. Tools like the application of AI in engineering biology both accelerate and democratize the development of technology. Also, there are several countries and areas severely underrepresented in synbio innovation. Despite the excellent job done by initiatives such as SynbioAfrica in bringing awareness and fostering talent, setting up a company in, say, Uganda or Kenya might be a herculean task without significant external support. And this is something we need to change.

A challenge these companies may need to address is perception by the community. “The next synbio champion is not necessarily doing a PhD in the Bay Area or Boston. Maybe it is someone training in Buenos Aires or Santiago, or maybe it is in São Paulo”, Buchara pointed out. suBBu brought up the individual responsibility of each stakeholder in the synbio space. “Action leads to motivation, and motivation can lead to inspiration. Each entrepreneur, government representative, and academics must start doing their bit and be audacious in their vision”, he said.

Countries in the global south are the most vulnerable to the effects of climate change, geopolitical instability, food insecurity, and lack of resources. “The world cannot continue growing as it is,” Berman noted. Synthetic biology will have its most significant impact there, and the innovation must include the local communities and stakeholders. Fortunately, founders and investors are optimistic, and the rest of the world needs to back them up with mentorship, visibility, and inclusion.