Engineered Human Therapies

How Do We Unite Synbio and Pharma? Insights from SynBioBeta 2023

The synbio community often talks about the industry’s lofty promises to solve many of the world’s biggest problems, but how are we actually doing in bringing synbio into our day-to-day lives, especially when it comes to our health?

Jun 14, 2023

The synbio community often talks about the industry’s lofty promises to solve many of the world’s biggest problems. And we should talk about that. The youthful willingness to take big risks and chase moonshots is a wonderful and unique characteristic of our community.

But how are we actually doing in bringing synbio into our day-to-day lives, especially when it comes to our health?

Until recently, the answer has been “pretty poorly.” Change has come sporadically. And though CAR-T cell therapies and mRNA vaccines have been tremendous breakthroughs, those technologies are far from ubiquitous. As I’ve written about previously, synbio for human health demands a full-stack approach. At SynBioBeta 2023, we got our first real look at that stack coming to life.

Synbio companies are now releasing key products to the market with immediate applications in drug discovery and manufacturing. In an exciting announcement at SynBioBeta, a leading cell reprogramming company, bit.bio, launched custom disease model cells so researchers can more easily recapitulate any cell type or disease-relevant mutation at any stage. Additionally, Ginkgo Bioworks’ platform is now being used to help meet rising vaccine demands, Absci, a company using generative AI for antibody design and discovery, is preparing for its first IND, and living medicines company, Synlogic, has just announced its global Phase III trial for its phenylketonuria (PKU) treatment.

The synbio stack is here and ready for prime time in biopharma. But some critical gaps still need to be filled first before it’s fully embraced by what is arguably the industry that needs it the most.

Give Us the Tools, and We’ll Finish the Job

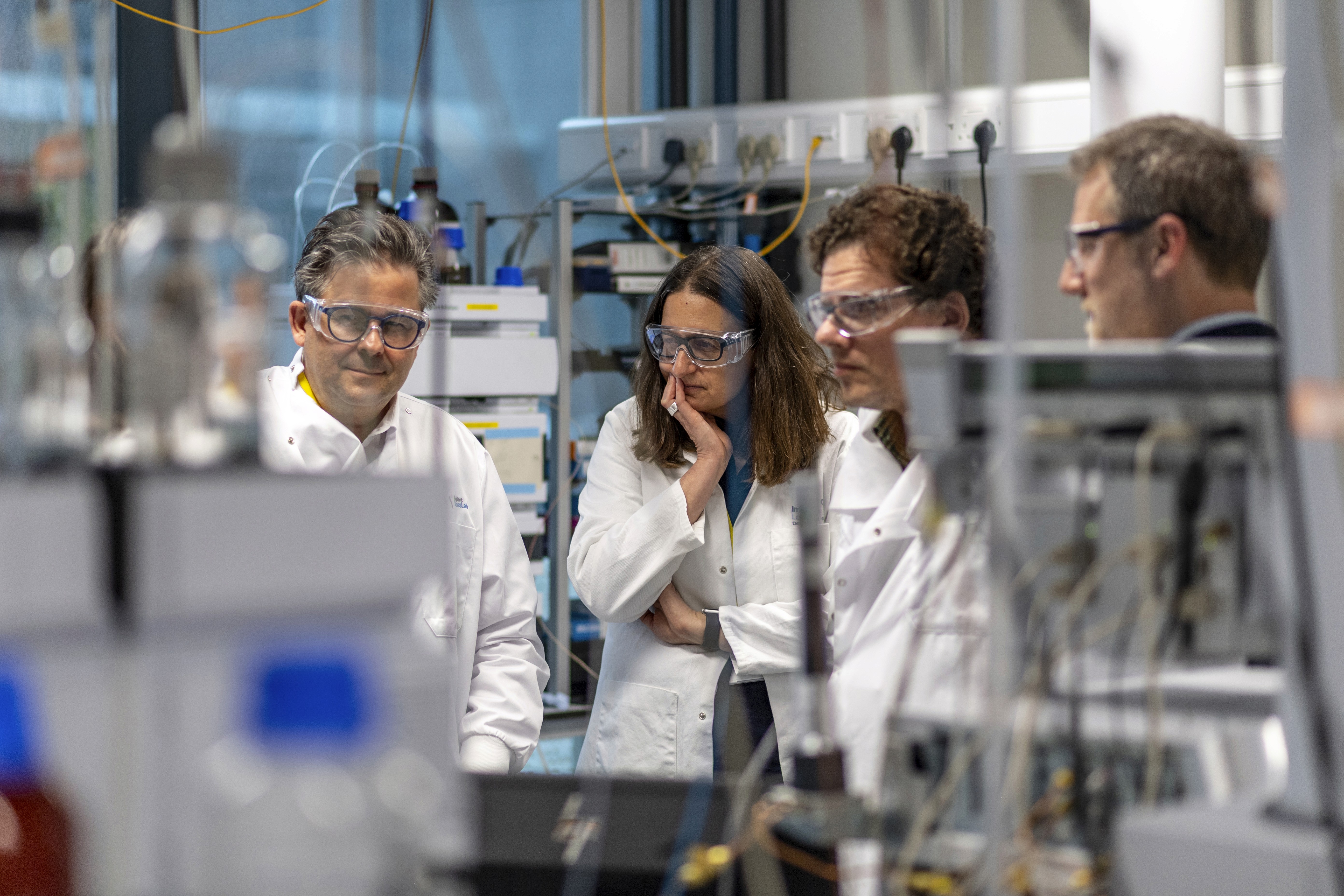

One important gap is that biopharma still doesn’t have all the tools—either because we haven’t developed them yet or we haven’t figured out how to bring them into the drug discovery and development pipelines. This was a topic of deep discussion during day one of the SynBioBeta conference, which built on a concerted effort to bring the Synbio and pharma industries together at the event for the first time.

The role of AI in drug development was a particularly hot topic. Mohsen Hejrati, Senior Director and Head of AI Engineering at Genentech, said, “There is a lot of potential to connect all of these pieces [individual tools and technologies] together, and we can mix biology and AI to get to solutions faster,” adding that for the value of new modalities to be realized, “all disciplines from software to computing to biology and medicine all have to really work together.”

Artificial intelligence can also make a big impact on human health by unleashing discovery value from synbio tools. Often, these tools come with an implementation cost that can “scare” away big biopharma companies. Pharma drug discovery tools and pipelines have already been optimized for cost-effectiveness. Bringing existing tools like DNA writing, reprogrammed cells, and other biological techniques together with AI will enable biopharma companies to actually extract value out of all of those data points and make the upfront costs worth it.

This key point was perfectly encapsulated by Thaminda Ramanayake, former VP and Global Head of Business Development for Oncology at Sanofi, and incoming CBO of Affini-T. “All [application areas] are very relevant for us. Synbio is creeping into managing costs and improving efficiencies, and increasing the probability of success. The real, high-value impact of synbio is going to be in therapeutics. Pharma tends to be asset-centric when looking at business development, and I encourage the [pharma] industry to think about innovation-centric business development.”

Bridging the Expanse

The other big gap is that biopharma simply doesn’t understand the value proposition of the entire synbio stack. This is always a surprise to be because the pharma community has been using synbio for decades. Big pharma is “the granddaddy of synthetic biology,” John Nicols, the former CEO of Codexis and current CEO of Organicols, said, referencing Genentech’s transformative move using E. coli to make human insulin over two decades ago. But there are a few key reasons why the value prop of synbio for biopharma has stagnated a bit. One is that improved efficiency doesn’t cut it anymore. Synbio tools need to bring more to the table.

Behzad Mahdavi, the SVP of Biopharma Manufacturing & Life Sciences Tools at Ginkgo Bioworks, reminds us that “Efficient, safe, scalable, and cost-effective go together. The opportunity with synbio is to truly optimize the biologics” said Mahdavi. This enables us to make therapeutics safer and scalable, naturally increasing the cost-effectiveness of biopharma processes.

“We [also] need to expand this concept of using cells as therapies from cancer to other fields of medicine, like regenerative medicine,” added bit.bio’s Mark Kotter. Biotherapeutics have typically relied on less complex organisms like bacteria because human cells have been very hard to program. This has now changed, potentially unlocking huge new drug classes.

Of course, there is a lot of nuance contributing to the gaps between synbio and pharma. A major theme in bringing them together will be how the synbio and biopharma communities communicate. Lesley Stolz, VP of Early Innovation Partnering at Johnson and Johnson Innovation, explained, “One thing to remember about synbio is that it is not the solution by itself—synbio is about teaming up with domain experts.” Referencing our community’s “much higher appetite for complex genetic engineering” than biopharma, Stolz highlighted that embracing that appetite and partnering with synbio can enable biopharma to tackle the challenges currently on their radar: applying sophisticated control to treatment localization, timing, and dose.

While the moonshot ideas were still present at SynBioBeta this year, they came with a bit more substance—tools that are actually delivering products—and with a more sober nod to the challenges that remain and how to address them. There are still very few synbio-enabled therapies on the market, but momentum is slowly building as biopharma companies increasingly realize that synbio really can enable them to innovate faster. After what I saw and heard at SynBioBeta, I can only echo the sentiment of FYT Consulting’s Yves Falanga: “It’s going to be complex, but I’m excited for the ride to see where this goes.”

Thank you to Embriette Hyde for additional research and reporting on this article.