Bioeconomy Policy

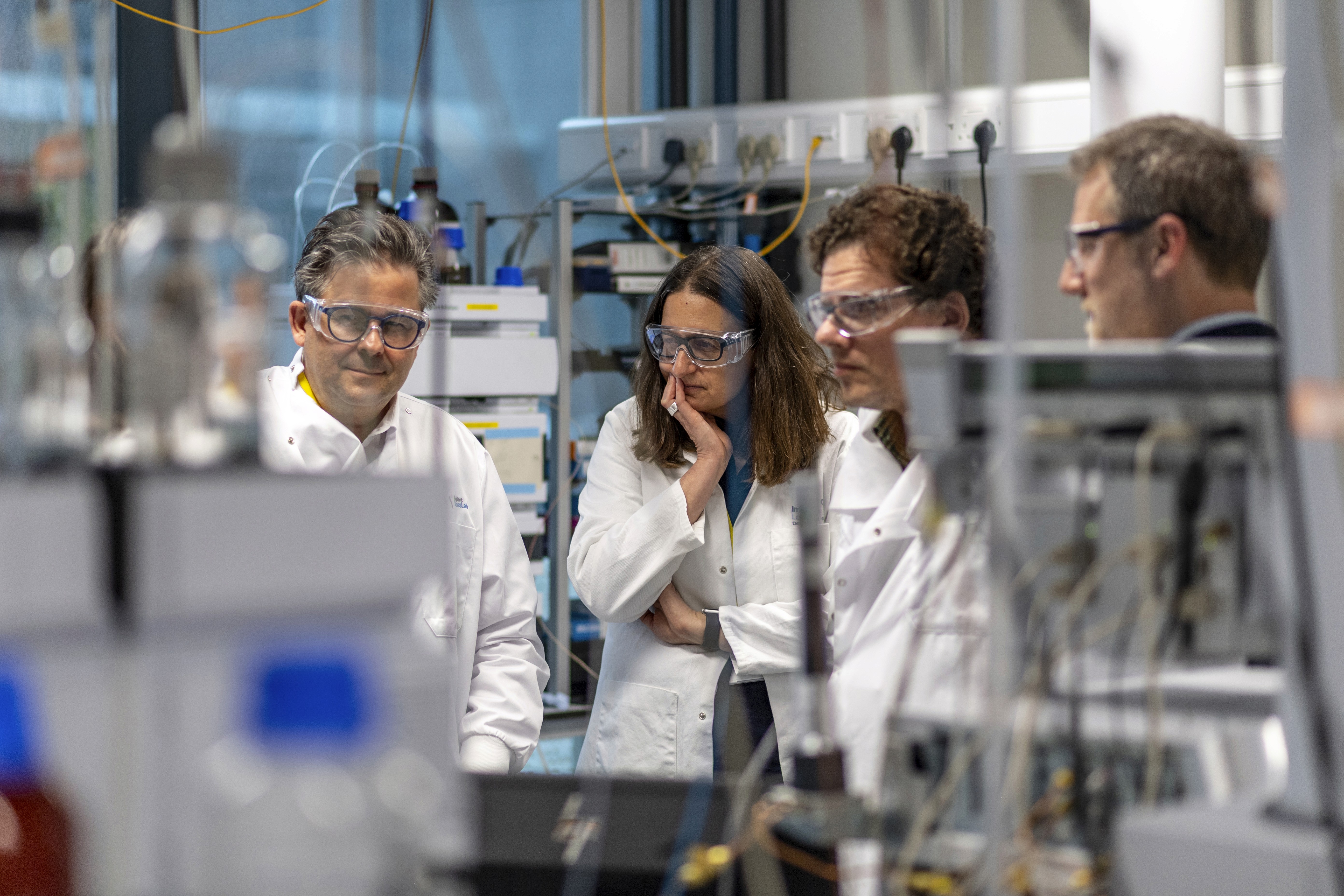

Building A Durable Bioeconomy Demands New Mindsets and Approaches

Building a thriving bioeconomy requires strong partnerships between industry and government and creating a modern ecosystem focused on accelerated commercialization

Jul 17, 2024

[DALL-E]

A significant expansion of a global bioeconomy is underway with unprecedented potential to address major issues of food and energy security, national security, climate change, and for the US, an opportunity for sustained economic competitiveness. The need is urgent as we attempt to address persistent existential threats to society. The task is fraught with challenges, given the need to mitigate the environmental damage of the past century coupled with a rapidly growing population that will top 10 billion in 2050. To accommodate this population growth, food production must increase by 70 percent on less land, with restricted access to water, and confronted by weather extremes. Furthermore, population growth will increase the demand for carbon in the chemicals and materials sector alone by 200% by 2050.

A recent McKinsey report (Bio Revolution Report, 2020) confirms massive opportunities for biobased solutions to address long-standing challenges and existential threats such as hunger, weather extremes, and poverty coupled with goals of de-fossilization and conversion to renewable resources. McKinsey estimated that even with currently available technology, up to 60 percent of global physical inputs could be biobased and that products in the current pipeline exceed $4T, of which 40% is non-healthcare. Expectations that biotechnology can address many of these problems are high. Even modest progress toward the goals could transform economies, societies, our physical world, and our lives, including what we eat and wear, the medicines we take, and the fuels and chemicals we use. A quarter through the “century of biology,” we are at a breakout point, yet a sober reminder is the fact that over the past 50 years outside of healthcare, success stories have been modest and without blockbusters. In this opinion piece, we address this challenge and propose an industry-led effort to build a new ecosystem that accelerates the development and commercialization of biobased products.

Biobased Solutions: Addressing Global Challenges

We offer a strong case that the fundamental basis for biology to achieve these aspirations is already in place. The rapid convergence of enabling technologies from disparate fields, including the ability to read, write, and edit DNA, bolstered by quantum computing, machine learning, generative artificial intelligence (GAI), and robotics, enable us to move the needle. Notwithstanding Wall Street and media hype of AI, overlaying AI and quantum computing on genomics, metabolomics, and biodesign will accelerate solutions to time-and-capital intensive challenges in all sectors of the bioeconomy. The potential for generative AI is massive, from identifying genomics targets for the development of high-performing strains of plants, microbes, and biologics to understanding the complexity and risks inherent in scale-up to commercial strategies and other applications that would create new markets.

Coupled with rapid technical advancements, biotechnology, and synthetic biology are getting unprecedented public attention through political visibility and public sector financial support. This coincides with a potent market pull as consumers demand products derived from renewable sources and best practices in climate-smart manufacturing. From a historical perspective, we are in a sweet spot of “whole of government” support for a biobased economy.

As we bask in the perceived potential and enthusiastic support, we must be realistic and recognize that over the past forty-plus years, apart from healthcare, there have been few commercial success stories despite significant investment and big promises. There have been several industrial biotechnology successes that currently generate substantial value. Examples include Amino acids, vitamins, lactic acid, citric acid, Polyhydroxybutyrate (PBB) & Polylactic acid (PLA), 1,3- propanediol, enzymes, ethanol, antibiotics, specialty proteins, probiotic microbes, microbes for agricultural applications, and several transgenic traits in crop plants. While each of these has been impactful in targeted markets, the time to get to market has taken 20 years or more, and most of these were based on technologies developed 30 or more years ago.

One must only look at the market cap of public companies in the synbio sector to realize that few, even committed, investors have realized significant financial returns over the past 25 years. Most companies in the sector are currently pivoting to new business models as they struggle to satisfy investor expectations and raise the sustained capital needed for commercial success.

Building a Modern Bioeconomy Ecosystem

Currently, the timeline from discovery to even modest market success is 15- 25 years, well beyond the patience of investors or politicians. Contributing factors are complex and interrelated and include extended development and regulatory times, time to access capital and partnerships, slow market adoption, and challenges to value creation and value capture. The challenge is to amplify and speed up the process of market entry and monetization. To illustrate, In the last several decades, billions of dollars have been invested in companies managed by bright, experienced, and passionate entrepreneurs built on cutting-edge technology. Yet commercial successes are not on par with the large inputs of capital and strong leadership. Clearly, these modest results are neither based on a lack of technological advancements nor due to a lack of risk capital, bio-manufacturing capacity, or strong leadership.

This state of play compels us to step back and ask, “Why the slow motion to market entry and investment return?” We suggest that what is needed is a new mindset and new approaches to create and nurture an ecosystem that accelerates the commercialization of innovation in parallel with installing a globally optimized, massively scaled, highly efficient bio-based supply chain to meet the challenges of climate change, food security, national security, and sustainability. We must develop a cohesive and modernized ecosystem in which innovators and entrepreneurs can efficiently and timely access critical resources, enabling them to achieve market success. We need new mindsets to instill and nurture a new culture. The adage: “culture eats strategy for breakfast” is relevant to the situation. Indeed, now is the time to align and commit to addressing the elephant in the room: the long time to market. If we do not address this issue, support will evaporate, and the opportunity will be lost.

Public-Private Partnerships: The Key to Bioeconomy Success

Building a thriving bioeconomy will require strong interdependent partnerships between industry and the public sector. Government has had fits and starts of support in the past, but currently, there is a new commitment to address food security, national security, supply chain resiliency, and to mitigate the impact of climate change. One can easily come up with a long list of things that government must do related to policy, incentives, purchase agreements, capacity building, and a sustained commitment that will attract risk capital from the private sector and ensure that the economics of the bioeconomy work. A sustained commitment by the public sector is critically important for a sustained industry, just as it has done for others, the latest being EVs. One key factor in keeping the public sector motivated is competition from China. This concern should be reframed as a commitment advantage, not a technological advantage, allowing us to reinforce our long-term commitments without interruptions or political expediencies.

While government initiatives are fundamental, they will never be sufficient. Many government initiatives in the past, such as loan guarantees for facilities, have been offered, but the companies still failed. For example, policies were put in place to support cellulosic ethanol production, but today, some 15 years later, there is hardly enough ethanol produced for a good happy hour! Success will require not just government support but an industry-led effort to revitalize the ecosystem.

We agree with the conclusion of a recent paper by the Alternative Fuels and Chemicals Coalition entitled “Building a Robust Bioeconomy: A Statement of Concern and Call to Action,” which proposed industry-led solutions. The report focused on the challenge of reducing the time to market to accelerate investment returns. The report concluded that major changes are required in how the industry engages along the entire value chain, developing new individual company business models, and recognition by the public sector to consider the bioeconomy as a new high priority that merits predictable and sustained long-term support to undergird an enduring and competitive bioeconomy.

We believe that industry must think differently and embrace new approaches, such as open innovation and a modern ecosystem that promotes success by emphasizing accelerated commercialization. An ecosystem that fosters collaboration, cooperation, and access to resources and consultation in a timely and frictionless fashion. We envision a one-stop clearinghouse for ready access to resources, capital, experienced advice, and partnerships devoid of duplication of what is already available, all accessible regardless of company size or stage. What is needed is facilitated engagement by stakeholders spanning the value chain from the earliest stages of development. It will not be easy as it will require a change in mindset, including giving up individual company “control” to build an ecosystem for the long-term good of the industry.

It is not a moment too soon to set the framework for positive and promising action by all sectors and verticals, from pharma to agriculture and food to biomaterials to engage and shore up the underpinnings of a durable bioeconomy. Great outcomes will result from transparent and structured facilitation as the basis for partnerships and the intention of win-win collaborations underpinned by mutual trust.